Dividend Tax Rate 2025 Philippines 2025. Take a look at some of the best practices for effective tax planning in the philippines: There are lower tax rates available for corporations with net.

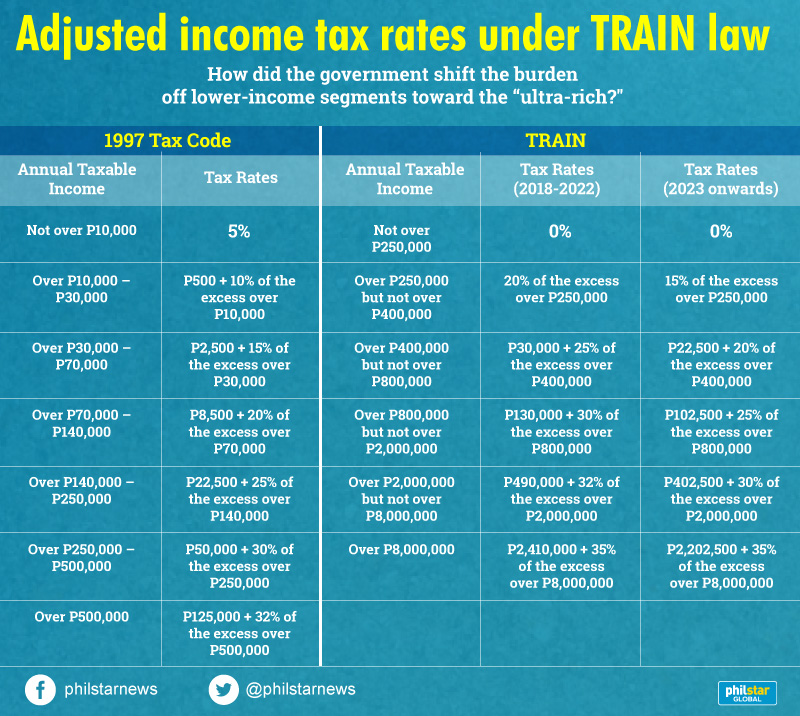

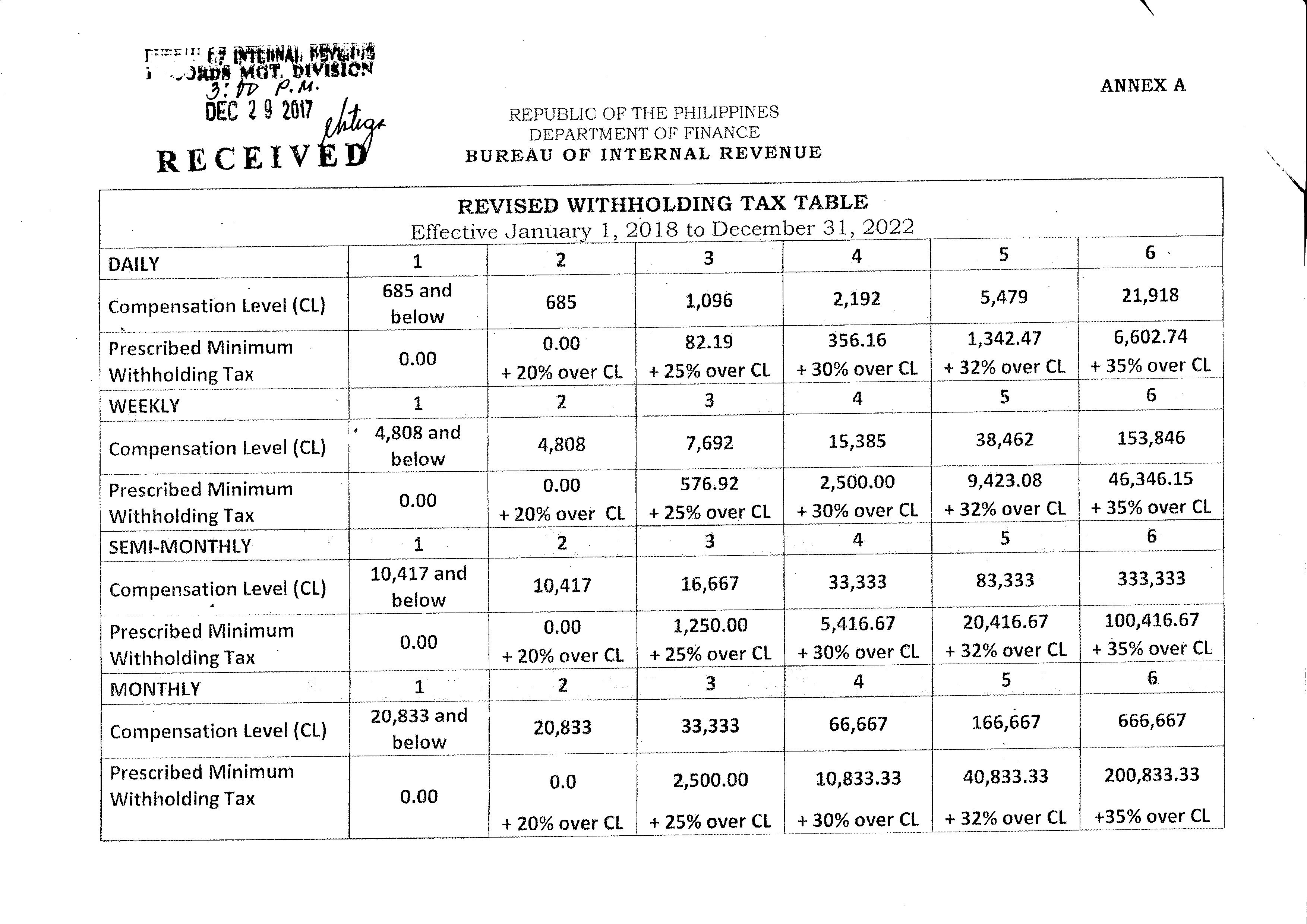

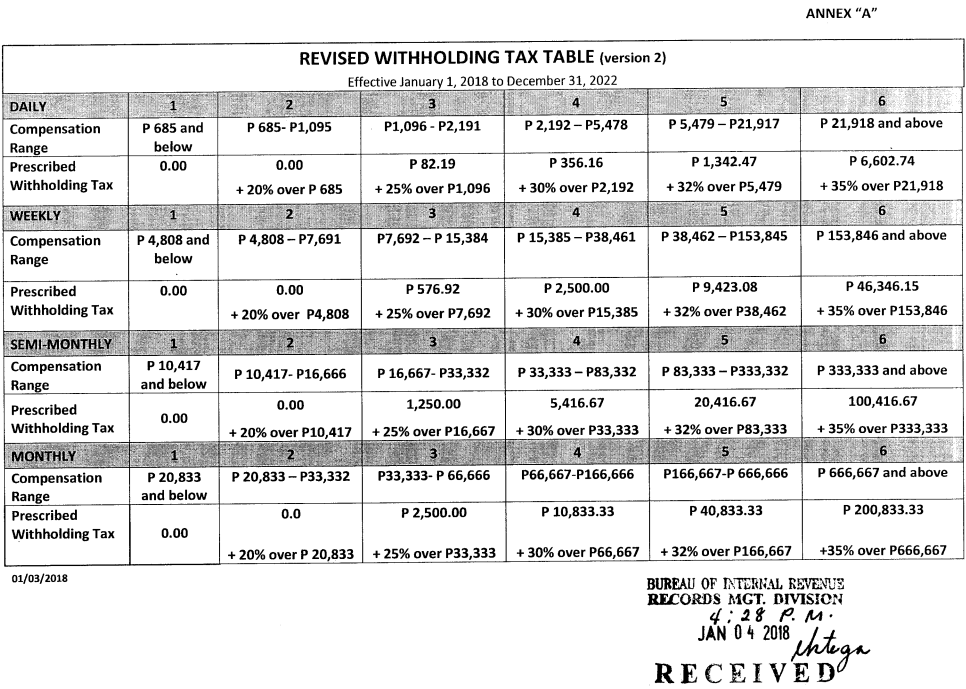

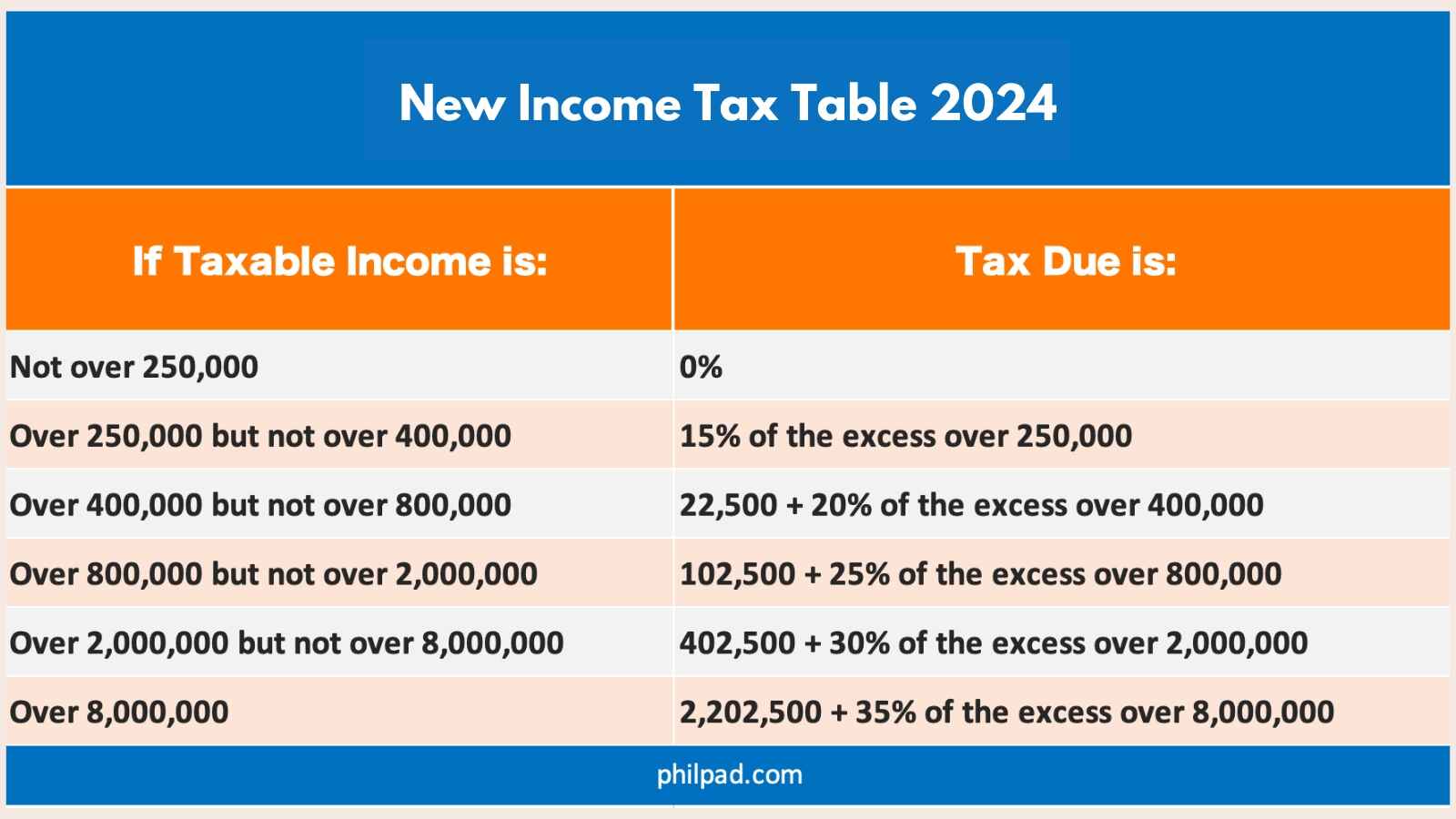

Discover the philippines tax tables for 2025, including tax rates and income thresholds. Get familiar with the philippine income tax table for 2025 and know your tax bracket, the amount owed, and how to compute your tax dues.

New Tax Table 2025 Philippines Joye Ruthie, The amount required to be invested in vz = 3600/ (6.51%) = $55,300.

Individual Tax Rates 2025 Philippines Image to u, However, until june 30, 2025, the mcit is temporarily reduced to 1%.

Tax Calculator 2025 Philippines Semi Monthly Aryn Maybelle, Clarifies certain issues relative to the implementation of section 19 of ra no.

Capital Gains Tax Rate 2025 Philippines Image to u, Austria, spain, ireland, belgium, new zealand, singapore, and the philippines.

Percentage Tax Rate 2025 Philippines Kacy Lisetta, Tips for effective tax planning in the philippines.

Tax Bracket Philippines 2025 Loren Raquela, However, until june 30, 2025, the mcit is temporarily reduced to 1%.

Dividend Taxes 2025 Etty Maurise, Dividends received by foreign (resident) or domestic corporations from a domestic corporation are not subject to taxation.

Tax Bracket Philippines 2025 Alis Gwendolin, Minimum corporate income tax (mcit) is temporarily.

Tax Brackets 2025 Philippines Cody Mercie, There are lower tax rates available for corporations with net.

Tax rates for the 2025 year of assessment Just One Lap, We used the exchange rate of 20 mexican pesos per us dollar as of aug.